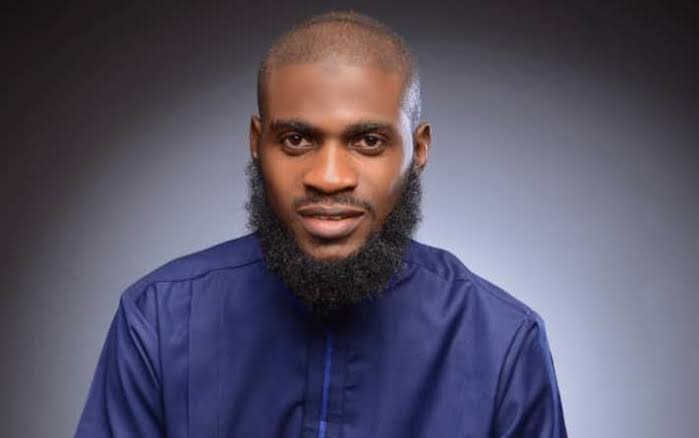

Ridwan Sanusi is a composite finance and investment professional. He is also the CEO and Co-founder of WeFundMatch, matched with nine years of experience in banking, management consulting, financial training and coaching. He left his job as a leading facilitator in one of the most prestigious management consulting firms in the country to start, the Muslim Finance Coach, a personal finance training and coaching outfit targeted at helping Muslims to attain financial freedom through smart money management and investment decisions. He leads a team of experts in technology, Islamic finance, credit analysis and Islamic jurisprudence to bridge the funding gaps of SMEs in Nigeria, using a digital platform that will match Halal investors to SMEs seamlessly. In this interview with The Nigerian Xpress, he talks about his job as a finance and investment coach and how he helps Muslims to screen and identify various halal investment opportunities across the world

As a finance and investment professional what endeared you to this field?

My journey unofficially started in April 2017, on a bright Monday morning after I decided to quit my corporate training job based on some personal grounds.

After dropping the news that sent shivers down the spines of my directors, I knew I was in for a “rollercoaster”. I had valid excuses not to quit. I had an excellent working relationship with my directors; my wife was about to be delivered of our first child in another country; I had little savings that could barely last us for three months, and I had no concrete financial plan.

However, with two years of hard work and frustrations, I turned my finances around. I started “consuming” personal finance books and videos by money experts like Robert Kiyosaki, T.Harv Eker, Dave Ramsey and others. But there was a missing link.

How do I apply their modern financial principles to my life without losing my Islamic values?

All through that time, I wished there were a Muslim Finance Coach to whom I could turn for help – but I never found one. This idea gave birth to The Muslim Finance Coach. I was the first finance and investment coach in Nigeria focused on helping Muslims to build a solid financial future that they and their families deserve.

You set up a coaching outfit, Muslim Finance Coach. What are some of your activities and how are you driving your cause?

The Muslim Finance Coach is a personal finance and an investment coach. This is my personal brand. I started it because I saw the need for people, especially Muslims to be financially educated so they can take control of their finances. I believe the first step to building wealth is to be financially literate. Just like the popular saying goes “Making more money won’t make you rich, knowing how to manage it will”. You can’t manage money if you lack financial knowledge or financial skills.

Some of my activities include: One-on-one coaching, group coaching, financial training and seminars, investment advisory, financial planning, e.t.c.

I use digital tools to drive most of my training and coaching activities. I share valuable financial and investment tips regularly on social media where I get most of my clients. The COVID pandemic and the lockdown gave me an opportunity to widen my online reach and to increase my engagement on social media platforms, especially on Instagram where I am mostly active.

As a finance and investment coach, I help many of my clients to gain financial security, ditch their debts, earn extra income from halal investments, and increase their net worth in keeping up with their Islamic values.

Setting up Smart Halal Investors Club and then WeFundMatch, what makes them unique in the Islamic finance space?

Although they seem to be operating within the same space, they serve two different purposes. Smart Halal Investor Club (SHIC) is an investment community where members have exclusive access to credible halal investments that have been verified to be Shariah-compliant and that give a high Return on Investment. Our focus at SHIC is to create a guilt-free way for our members to build generational wealth by providing them with a diversified portfolio of investments in various asset classes (e.g real estate, fixed income, agriculture, startup investing, stocks e.t.c.) and different regions.

WeFundMatch is a peer-2-peer business financing that I co-founded with two of my friends. It is a Fintech solution to solving the twin problems of obtaining ethical funding faced by SMEs and earning good returns on halal investments faced by investors. We use the latest technology to match these two drivers of the economy seamlessly.

Are your investment activities restricted to Muslims?

Our community isn’t a religious organisation, hence our activities aren’t restricted to Muslims. As long as you are happy with what we do and you want to grow your wealth the ethical way, you are always welcome. In fact, one of the biggest investors in our community is a Christian. Our investments align with impact investing and ESG (Environmental, Social, and Corporate Governance), which are key factors used in measuring the sustainability and societal impact of an investment in a business. We do not only help our members make more money, we do it in an ethical way.

With reach across different countries, what have been the achievements so far?

The one thing that is driving our membership across different countries is my personal brand, as a Muslim Finance Coach. I share the same values as most of the people I serve. I feel their painp, I know their challenges and they trust me to help them in solving their problems of building wealth through halal investing. Many of our members are Muslims, who are in dire need of a guilt-free community where they can learn and earn without compromising their Islamic values. They want more money; they want to build wealth but they want to do it the halal way. They have seen something like what we are doing in other conventional platforms but they probably haven’t seen it being done for a Muslim community in the manner we are doing ours.

Our key success factors have been the varied investment opportunities with high ROI the level of investment due diligence and monitoring a tested and trusted platform to earn passive income without feeling guilty. The amount of learning materials and access to experts that members can learn from a supportive community to connect with.

Running an organisation, such as this, must come with its challenges, could you share some?

Challenges are normal events that all entrepreneurs encounter in their pursuit of impacting the lives of the people they serve. I would say that the biggest challenge for me is getting credible halal investment opportunities for our members. Because of the limited number of halal investments and the dearth of Islamic finance education, especially in this part of the world, we struggle with getting investments that the market has already structured for our members who want to invest in line with their faith and values. Most of the investments that are available to investors in both the capital and money markets are not structured, using Shariah principles; hence, our members cannot invest in such. To address this challenge, we designed a model that will enable us to structure credible investments that have been verified by our in-house Islamic Scholars to be Shariah-compliant. We ensure that all our investments pass through a rigorous Shariah Screening process and business analysis test before they are presented to our members.

The other main challenge is getting high yield investments. Many of our members complained about the low returns on investments they were getting from other platforms or organisations. One of our biggest commitment to our members is a high return on investments. We look out for opportunities and negotiate deals in key sectors of the economy that will give our members a high return on investments. For instance, our members have enjoyed investments with 15% – 20% ROI per month, 35% ROI in 9 months, 30% ROI in 10 months, 20% ROI in 6 months, 15% – 20% in 4 months.

Finally, if you look at the Islamic Finance Market, especially in Nigeria, you’d agree with me that investors have limited options to choose from. Because we structure most of these investments, we are able to get as many as 2 – 3 investments per month for our members.

As a certified Finance Islamic Executive, what is your assessment of the sector at the moment?

The Global Islamic Financial Market has witnessed a rapid growth over the last decade. The global Islamic finance assets grew by 14% in 2019 and are expected to rise to $3.69 trillion by 2024.N Nigeria is not left out of the massive evolution of the global Islamic financial market.

In the last decade, we have seen new players emerge in the Islamic financial service industry, including commercial banking, insurance, asset management, investment-banking, etc. In addition to the products designed by their Islamic counterparts, conventional financial institutions like FBN quest, United Capital, ARM and others have designed halal funds that will cater to the investment needs of this hugely underserved market.

In the past five years, the Federal Government has issued three separate Sukuk that were primarily channeled into capital projects.

In 2020, the NSE Lotus Index outperformed the All Share Index by more than 5%.

These metrics are strong indications that the Islamic financial sector has huge potential that mustn’t be neglected. The sector can play a massive role in driving changes in key sectors of the economy through socially responsible financing and impact investing.

Post-COVID lockdown has led to a lot of financial constraints, how are you driving the cause in these times?

I am one of those who believe that COVID came as a blessing in disguise (depending on how you look at it). Yes, COVID created some unprecedented crisis for many nations, especially for vulnerable countries like Nigeria but amidst those crises are opportunities. My job as an entrepreneur and an investor is to identify the opportunities and turn them into value-driven activities that will generate more income for me and my members. In the heat of the pandemic, many investors were wary of where to put their funds because of the uncertainties in the market.

The bearish nature of the stock market in 2020 gave investors one of the highest returns ever made in the capital market. Because of some of the limitations of investing in the stock market faced by halal investors, many of our existing and potential members were unable to tap into this opportunity.

So, we decided to replicate the same level of performance in the club by focusing on structuring deals in Sectors / for businesses that are unaffected by the lockdown. They are businesses that will continue to receive demand for their products from customers regardless of changes in business conditions.

Furthermore, in order to drive membership growth, we strengthened our online footprint by organising webinars, sharing valuable content on social media. Over 90% of our members came through these means.

What are some of the changes that you will like to see in the finance and investment sector today?

The current state of the Nigerian economy calls for various government reforms and initiatives that should be targeted at creating an enabling environment for various financial players and local businesses to thrive. Many local investors are seeking alternative means to protect their wealth against rising inflation and currency devaluation by investing abroad. Whilst that is good, I am one of those who believe that there is a lot of money to be made in this country regardless of whether you live in Nigeria or not. Smart investors mustn’t neglect Nigeria even in the midst of economic and security challenges we are facing. This is a country unlike many others where you can get maximum returns on your investment within a short term.

I’d like to see more intervention funds channeled to sectors that are helping to resuscitate the exploration of our mineral resources and the manufacturing of such into finished products that can be sold both locally and internationally. Government policies should be reviewed from time to time to make it conducive for local players to compete effectively with their global counterparts; doing these will help to drive more foreign and local investments into the economy.